NextAdvisor’s Just take

- Focuses on taking qualities and you can advice into the army neighborhood

- Now offers zero-down-payment mortgage loans

- Has flexible borrowing requirements

- Will not fees private mortgage insurance

- You could protect their interest rate and relock it twice when the cost increase

- Membership is bound to help you solution players, experts, and you will specific authorities builders

- Will not promote FHA money and you will USDA loans

- You’re going to have to consult a personalized price offer

Along with its expertise in the army area and you can reasonable-rates mortgage options, Navy Government Borrowing Relationship is an excellent choice for qualified consumers. To apply for a mortgage using this https://cashadvancecompass.com/installment-loans-tx/austin type of lender, you (otherwise a family member) will need to be of this military, the fresh Service from Defense, and/or National Guard. While you are ineligible having subscription otherwise you are searching for a keen FHA mortgage, USDA mortgage, or domestic security tool, your best option is to try to search elsewhere. Just like any economic tool, it certainly is smart to contrast even offers whenever you are searching to take out home financing.

Article Independence

As with all your lending company ratings, the investigation is not influenced by people partnerships or adverts dating. To learn more on the our very own rating methodology, click on this link.

Navy Federal Borrowing Partnership Full Feedback

Headquartered when you look at the Vienna, Virginia, Navy Federal Borrowing from the bank Commitment is depending within the 1933 and today caters to more than ten million players that have 344 twigs all over the world. It obtained an over-mediocre rating into the J.D. Power’s 2020 You.S. Top Financial Origination Fulfillment Investigation and will be offering the full suite regarding financial attributes for its people, also mortgage loans, automobile financing, examining and you will coupons membership, student loans, and much more.

The Navy Federal’s lenders feature zero down-payment, zero private mortgage insurance rates, and you may positives to have provider players and their family. But you will must get in on the borrowing from the bank partnership before you apply to own a mortgage. In order to become an associate, you otherwise a member of family will need to be associated with the army, federal guard, or the Service away from Coverage. If you are eligible, this is what to learn about the lender.

Navy Federal Borrowing Union’s fund try aimed toward provider players, experts, and you can specific bodies group. In fact, Navy Government originated more than $eleven.6 mil into the Agency regarding Experts Factors mortgages (Va money) into the 2020 by yourself, so it’s this new 6th-premier lender by regularity for it particular mortgage. But it also has the benefit of other types of home loans, including:

- Traditional repaired-speed fund

Navy cannot offer Federal Casing Administration mortgage loans (FHA finance), U.S. Institution regarding Agriculture mortgages (USDA money), renovations fund, contrary mortgage loans, or any other specific niche points.

Among Navy Federal’s specialized financing ‘s the Homeowners Options program, which is aimed toward first-big date homeowners. The borrowed funds means zero advance payment or individual home loan insurance, and you may borrowers may be able to wrap the fresh new financing percentage to the the borrowed funds or obtain it waived in return for a top interest rate.

Various other device, brand new Military Selection system, also offers special prices into financial rates without down-payment for effective-duty and you can veteran consumers. The product quality step 1% financing origination percentage and you may step one.75% money percentage is going to be folded for the financing or waived when you look at the change to own a top rate of interest.

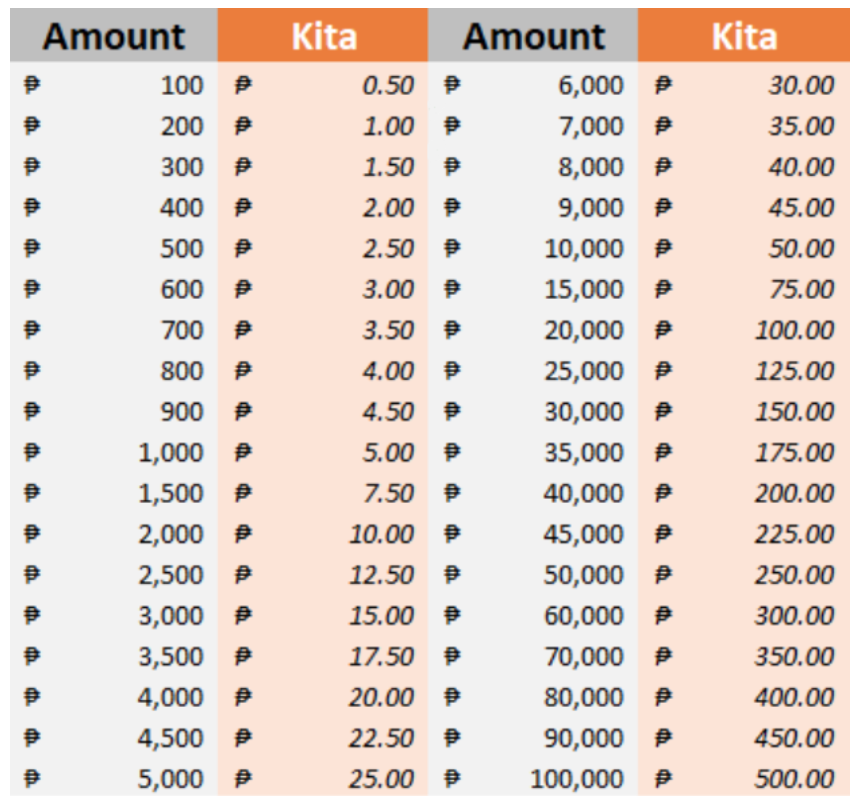

Navy Government now offers a free provider titled RealtyPlus, which suits people which have realtors and provides money back within closing in the event that house is bought or sold from the called representative. With regards to the house’s purchase price, the money-right back count can vary out of $eight hundred in order to $8,100. The applying isn’t really for sale in Iowa, and you will residents out of particular claims will get discover a mastercard provide cards otherwise fee cures at the closure unlike head cash back. Consumers inside the Arkansas, Louisiana, and you can Oklahoma aren’t entitled to money back, but may nonetheless make use of getting customized service away from an excellent RealtyPlus planner being coordinated with a representative.